Hi everyone,

We hope everyone had a great break and is off to a good start in the new year!

Macro & Market

Launch in Q4 showed a number of delays and timing slips towards year end, stressing the importance of remaining flexible regarding launch windows. The roster of new launch companies has not seen any contraction yet, even though SpaceX is still the only real game in town for reliable/affordable access to space.

The NASA OSIRIS-REx mission hit a snag in Q4 as they had serious issues getting to the sample they returned from asteroid Bennu. While the collection mechanism had a lot of surplus material around it that exceeded their return goals, the mechanism itself was bolted closed by 35 bolts including 2 that refused to open. The NASA team had to develop new tools to mechanically remove these bolts in the enclosed glovebox environment they are using to retain the sample in its original state as much as possible.

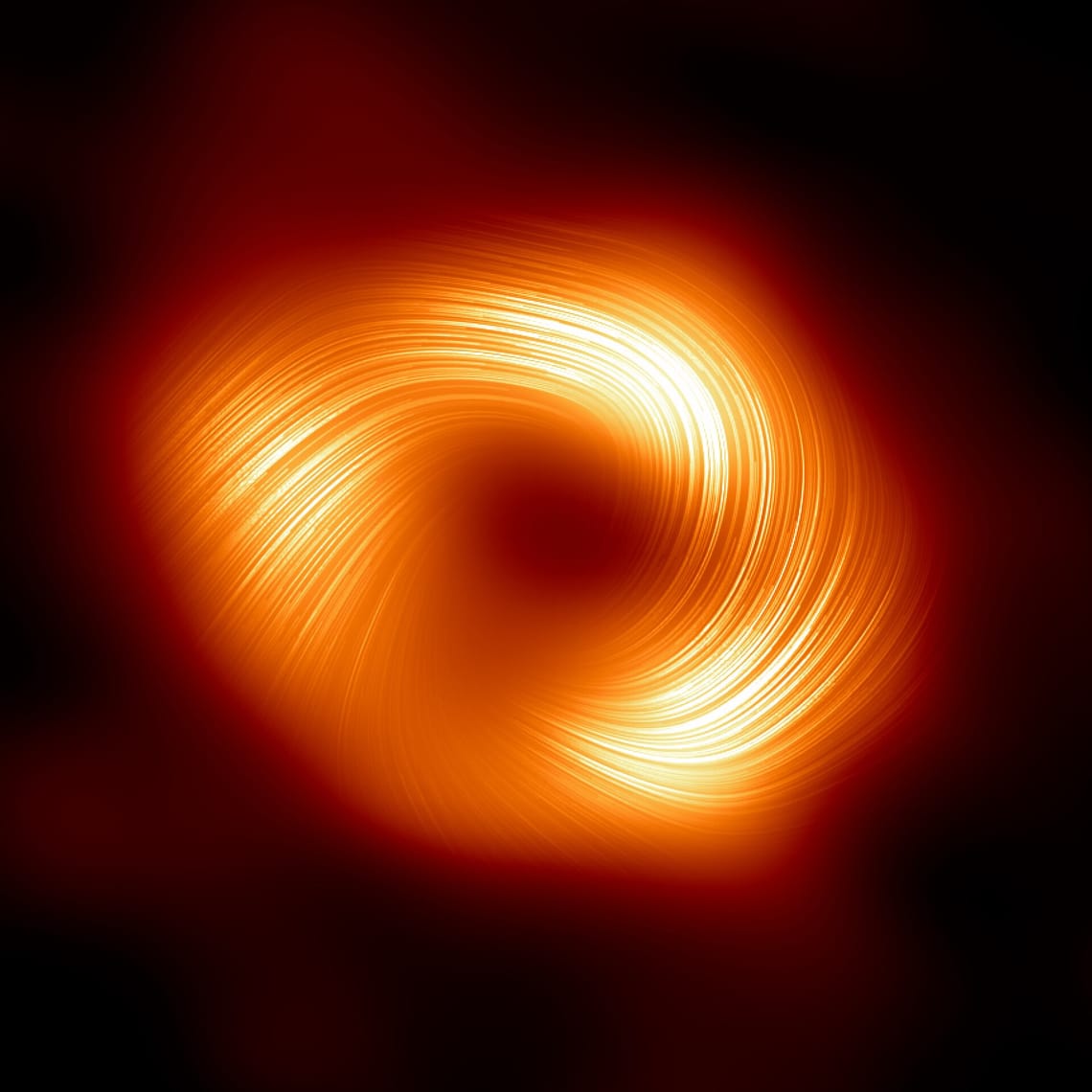

For those that did not see the second flight test of SpaceX' Starship, it is worth watching! While they did not manage to hit all of their mission goals, it was a massive improvement to the first test earlier last year. No blowing up the launch pad, setting fire to the surrounding State Park, no engine issues and a clean separation between the booster and Starship itself.

Credit: SpaceX

A lot has been written about how transformative Starship will be for the industry, the best piece of which is still Casey Handmer's 'Starship is still not understood'. We are firm believers in its transformational impact long term, but more bearish about the short term impact. Most of the launch volume will be SpaceX launching for SpaceX (Starlink) or SpaceX launching for NASA (refueling for lunar missions may need up to 20 launches), while we expect to see a big difference in the cost for SpaceX and the price for everyone else.

Capital markets remain challenging, with most late stage companies struggling to raise even with a lot of structure and on flat valuations. Early stage seems to be in a much better spot though, now that valuations have come down and expectations around capital efficiency are more widely distributed.