Market Update

The last 3 months has been an absolute rollercoaster in the macro sense with inflation staying high and markets slipping more and more. Startup values were inflated compared to public market comparables and have collapsed even more as funding disappeared. Space startups raised an aggregate of $47 billion in 2021, an amount that is expected to drop by 70-80% this year. A major hidden issue in these last years of funding drama is the feedback loop of space startups selling to space startups, where stacked ‘bookings’ are counted as future revenue used to raise capital.

Axios Space's Miriam Kramer: "The parts of the industry that are expected to be hardest hit include those focused on far-future concepts like asteroid mining and startups working to innovate new rocket concepts." Payload Space's Mo Islam: "The companies that can generate real paying customers today are the ones that have the best chance of navigating the fundraising vacuum we're in. If you fall into the 2nd or 3rd order business model and you don't have 12-18 months of runway, government contracts to bridge the gap to commercial orders will be critical."

Some deepdive material for those interested in more context:

‘2023 will be the year that the new space bubble pops.’

‘Space race dollars slow’

‘Payload Pathfinder podcast: The Macro View’

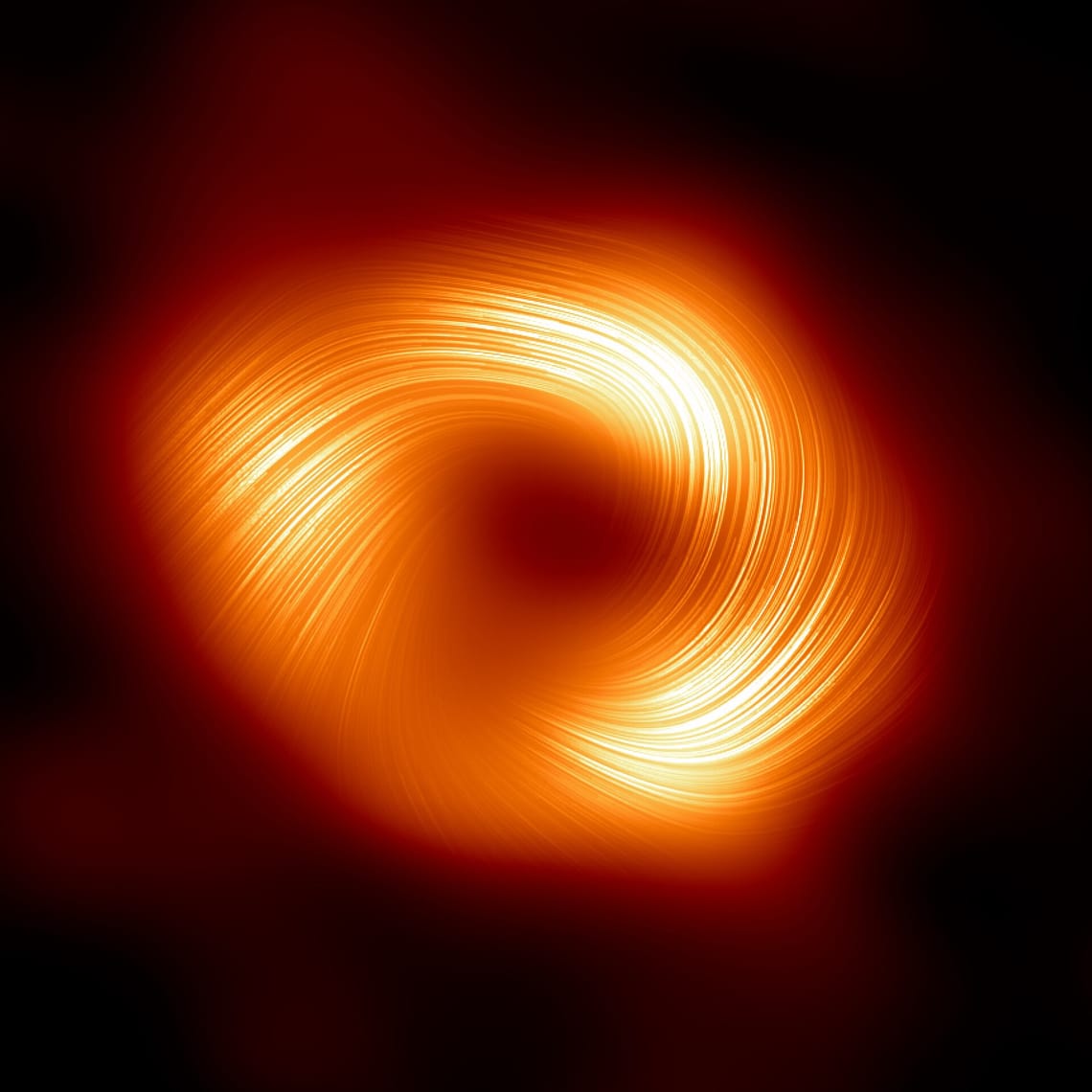

We agree with the general view that a lot of companies raised money without products, customers or a roadmap to get there. Many of those will fail, which makes recruiting a lot easier. The ‘far-future concept’ label for asteroid mining though…

On that note, last quarter also saw an announcement from a first ‘competitor’.